Do You Really Need Health Insurance If You’re Young and Healthy?

When you’re young, active, and rarely sick, health insurance might feel unnecessary — even like a waste of money. But the truth is, skipping coverage can leave you exposed to major financial risks that can derail your goals, savings, and future plans.

Let’s break down why health insurance for young adults is not just a smart choice — it’s a necessary one.

1. Accidents Happen — Even When You’re Healthy

Being young and fit doesn’t make you immune to accidents. A car crash, sports injury, or unexpected trip to the ER can happen anytime — and the average emergency room visit costs over $1,200, not including tests or procedures.

More serious incidents (like surgery or hospitalization) can easily climb into the tens of thousands — and without insurance, you’re on the hook for every cent.

2. Preventive Care Is Free With Most Plans

Most health insurance plans cover preventive services at no cost — even before you meet your deductible. That includes:

-

Annual checkups

-

Vaccines (like flu shots and COVID boosters)

-

STI testing

-

Screenings for blood pressure, cholesterol, and more

These checkups help catch small problems before they become big (and expensive) ones.

3. Health Insurance Is More Affordable Than You Think

If you’re under 30, you may qualify for Catastrophic Plans — low-cost coverage that protects you from major emergencies. Many young adults also qualify for subsidies through the ACA marketplace, significantly lowering your monthly premium.

There are also private plan options with low deductibles, telehealth access, and mental health benefits built in.

4. Mental Health Support Matters

Mental health challenges like anxiety, depression, and stress don’t discriminate by age — and they’ve become more common than ever. Quality health insurance includes:

-

Therapy and counseling coverage

-

Medication for mental health treatment

-

Virtual mental health support (included in many private plans)

Without insurance, these services can cost hundreds per month out of pocket.

5. Avoid the Penalties of Going Uninsured

While there’s no longer a federal penalty for not having health insurance, some states still charge a fee for being uninsured. But more importantly, going without coverage means you miss out on the peace of mind and protection you need to stay on track financially.

Even one unexpected medical bill could:

-

Drain your savings

-

Ruin your credit

-

Lead to long-term debt

6. Insurance = Confidence in the Future

When you have coverage, you don’t have to stress every time you get sick or injured. You can focus on:

-

Your career or business

-

Traveling

-

Living fully without fear of financial setbacks

It’s about protecting your lifestyle — not just your health.

So, Is Health Insurance Worth It for Young Adults?

Absolutely. Even if you rarely see a doctor, health insurance gives you:

-

Emergency protection

-

Access to free preventive care

-

Mental health support

-

Financial stability

It’s one of the smartest investments you can make in your 20s — and it only gets more valuable as life gets more complex.

✅ What Should You Look for in a Plan?

Here’s what to consider when shopping for young adult health insurance:

-

Affordable premiums: Check if you qualify for marketplace subsidies.

-

Low deductible options: Great if you expect moderate medical usage.

-

Telehealth and virtual care: Convenient, fast, and often included.

-

Mental health coverage: A must-have benefit in 2025.

-

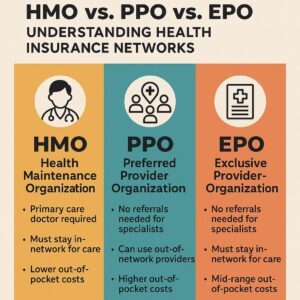

PPO plans: Offer more flexibility and provider access.

📞 Need Help Finding the Right Plan?

At Helping Hands Insurance, we specialize in helping young adults find affordable, flexible health plans that fit their lifestyle — without breaking the bank.

Let us help you get covered today.

👉 [Click here to get a quick quote]

Make sure you check out all of our blog content for additional resources and helpful tips and tricks here. https://www.helpinghands-insurance.com/blog/