Introduction: Why Health Insurance Is Critical for the Self-Employed

Being self-employed has its perks — you’re your own boss, you set your hours, and you control your income. But one major challenge many freelancers, gig workers, consultants, and entrepreneurs face is finding affordable and reliable health insurance. Without employer-sponsored coverage, the burden of getting insured falls squarely on your shoulders.

The good news? There are plenty of solid options available for self-employed individuals in 2025. Whether you’re looking for the lowest premium, the widest network, or access to telemedicine and wellness perks, the right plan is out there — you just need to know where to look.

This guide will walk you through the top health insurance options, what to consider before choosing a plan, and tips to make sure you get the best value for your needs and budget.

Top Health Insurance Options for the Self-Employed in 2025

1. ACA Marketplace Plans

The Affordable Care Act (ACA) created a health insurance marketplace that allows individuals and families to shop for coverage. Self-employed individuals can apply for these plans during open enrollment or a special enrollment period if they qualify.

Pros:

-

Plans are ACA-compliant and include essential benefits.

-

Income-based subsidies may significantly lower monthly premiums.

-

No denials for pre-existing conditions.

Cons:

-

Premiums and deductibles can be high without subsidies.

-

Some networks are limited (HMO plans are common).

Best For:

Self-employed individuals with lower or moderate income who qualify for subsidies or tax credits.

2. Private Health Insurance Plans

Private plans are purchased directly through an insurance company or licensed agent, and they often offer greater flexibility and customization than marketplace plans.

Pros:

-

More plan options and provider networks, including PPOs.

-

Greater control over deductible and coverage levels.

-

Often better for higher-income self-employed individuals who don’t qualify for subsidies.

Cons:

-

May be more expensive without employer contributions.

-

Some plans may have stricter underwriting or health questions.

Best For:

Self-employed professionals who want better network access and more personalized coverage.

3. Health Sharing Plans

While not technically insurance, health sharing ministries or programs are a popular low-cost option among some freelancers and small business owners.

Pros:

-

Monthly costs are often lower than traditional plans.

-

May include wellness incentives or lifestyle perks.

Cons:

-

Not regulated like ACA plans — fewer protections.

-

No guarantee of payment; based on “member sharing.”

-

Pre-existing conditions may not be covered.

Best For:

Individuals in good health seeking affordable, faith-based or community-driven options — with an understanding of the risks.

4. High Deductible Health Plans (HDHP) + HSA

High Deductible Health Plans often have lower premiums and can be paired with a Health Savings Account (HSA) to help cover out-of-pocket costs.

Pros:

-

Lower monthly premiums.

-

HSA contributions are tax-deductible and can roll over year to year.

-

Great for those who are generally healthy but want to protect against major expenses.

Cons:

-

Higher deductibles before coverage kicks in.

-

May require more out-of-pocket spending if you use medical services often.

Best For:

Entrepreneurs looking to save on premiums and invest in a tax-advantaged way to pay for future health costs.

What to Consider When Choosing a Plan

Not all plans are created equal — here are some things you should evaluate before making a decision:

✅ Monthly Premiums vs. Deductibles

Cheaper monthly premiums often come with higher deductibles. Make sure you’re comfortable with the out-of-pocket costs if you end up needing care.

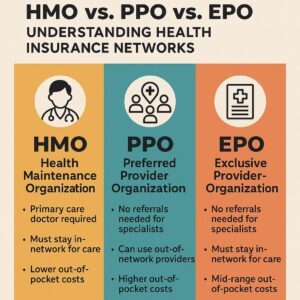

✅ Type of Network

-

PPO (Preferred Provider Organization) plans let you see out-of-network providers, often with no referral needed.

-

HMO (Health Maintenance Organization) plans are more restrictive but may have lower costs.

If you travel often or want more flexibility in choosing doctors, a PPO is usually worth the extra investment.

✅ Covered Services

Always check what’s included: prescriptions, mental health, specialist visits, maternity care, telehealth, etc. Not all plans offer equal coverage.

✅ Provider Access

Make sure your preferred doctors and local hospitals are in-network. If not, you could pay much more for care.

✅ Telemedicine & Wellness Perks

Modern plans often include virtual visits, mental health apps, and even fitness discounts. These can save time, money, and keep you healthier in the long run.

Tips for Saving on Self-Employed Health Insurance

-

Work With a Licensed Health Insurance Agent

Agents can help compare dozens of plans and find coverage that fits your exact situation — often at no cost to you. -

Deduct Health Insurance Premiums

If you’re self-employed, your health insurance premiums may be 100% tax-deductible — talk to your CPA or tax advisor. -

Shop Around Every Year

Plans and pricing change annually. Don’t just auto-renew — compare every year during Open Enrollment (typically November 1 – January 15). -

Bundle with Dental & Vision

You may get better rates by bundling health, dental, and vision together through private carriers. -

Stay Healthy

Investing in preventive care, fitness, and wellness helps avoid higher long-term medical costs — and could help you qualify for better plan rates.

Final Thoughts

Choosing the best health insurance as a self-employed person in 2025 doesn’t have to be overwhelming. Whether you’re just starting your own business or you’ve been your own boss for years, the right plan is out there — one that protects your health and your financial future.

Don’t wait until you need care to get covered. Start exploring your options now so you can have peace of mind all year long.

📞 Ready to Get Covered?

Need help comparing plans or finding a private option that fits your needs?

👉 [Schedule a Free Consultation Today]

Make sure you check out all of our blog content for additional resources and helpful tips and tricks here. https://www.helpinghands-insurance.com/blog/